Investing In Yourself – Using Pillars to Build Your Core | |

Setting Budgets + Saving for Black Swans | |

How to Open My First Brokerage Account | |

Diversify your Life (Mind, Body, Soul, + Investments) HOW TO SEARCH MY BLOG: | Get Updates to Your Email When I Create A New Post: |

How To Buy - Week of 9/26

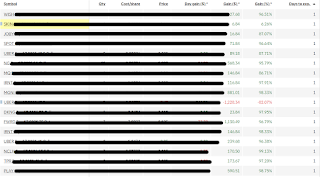

Pictured above is a stock chart of TEGNA (NYSE:TGNA). TGNA is a media company fka as Gannett.

The old Gannett provided news media -- think newspapers, your local TV stations, etc. They split these operations up and you can still own the slower growth newpaper business (USA Today and it's still know as Gannett) and the TV news / media business is now know as Tegna.

Still with me? Great, well I own Tegna. Need a better description, every time you watch your local news station...and it says Channel 13 NBC News, let's just say I thank you and my bank account thanks you. I first got into Tegna after 4 separate investors were looking to hook up with TGNA back in 2020 (note: ultimately TGNA decided against getting married). This was rough for the stock but I held because election years are great for news and media stocks and Trump, Biden, and the craziness of American politics did not fail. Trust but Verify, see this post:

September 2020 - This post was insight into WHEN and WHY I Bought Tegna:

Last year, Tegna rebuffed it's suiters like a millennial who declines dating someone because they didn't tick off EVERYTHING on their dating wish list. So similar to a break up, Tegna was suffering from the rebound blues. The stock was trading very low for awhile but I knew if 4 companies wanted to slide into their DM, then it meant TGNA was attractive. And by telling us what they would pay for hook up...we found PRICE DISCOVERY. Most buyout offers were around $20. Remember these #traderfacts because they help me be the best trader I can be.

Earlier this year, I sold 1/2 my position when TGNA reached the initial hook up price and I blogged about it. I've learned to never fully get out of my positions as I often miss out of additional good news later. I may have traded this stock the way it should be done. I held a big position, exited my first position taking my initial investment out and I'm guessing a 20% gain. Then let the rest RIDE!! See the links below as I post to give you insight into real life trading...not some of this podcast bs that you can get rich over night.

April 2021 - This post was insight into WHEN and WHY I Sold Tegna:

Fast forward to this week: TGNA has SURGED nearly 20% this week and at first I wasn't sure why. Well it turns out therrrrrre BACK!!! My friends in my Mansa Musa Network are trying to slide into Tegna's DM once again. This time the price is higher to get married and I've seen $22 (Byron Allen + Ares Managment) and $23 (Apollo) from 2 suitors.

I recently learned that one of my consultants in my cyber business follows my blog and trades after reading and learning from my posts. I hope to make it easier for us to trade notes in a community that's just for us. I hope to move my subscriber alerts to my "Discord" channel so you can learn How and Why I buy and sell. I also hope to learn from you.

Tegna netted me roughly a 35% profit and that came in less than a year for the April 2021 trade and now we'll be at above 35-45% based on the new hookup prices I've discovered.

#getthebag #howtobuy #tegna